When tenants forget to pay their rent, it is more than just an annoyance for landlords. For a start, you waste time chasing up cheques. Late rent payments may even have an impact on your cash flow, potentially putting you in the position where you can’t pay your mortgage.

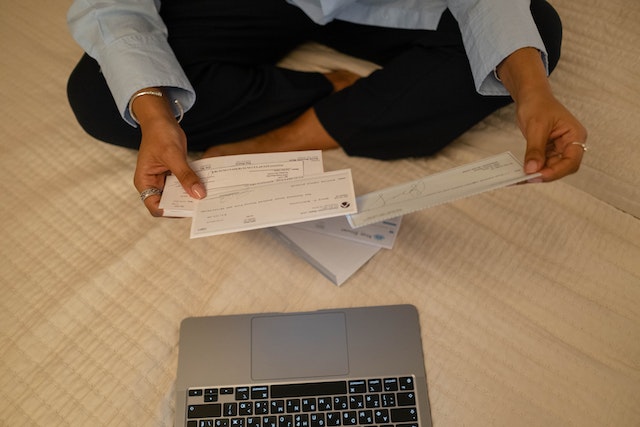

Despite the ease of online rental payments, studies show that 42% of people still prefer paying their rent by cheque and a further 22% in cash. This leaves little reassurance for landlords. There are several companies out there that promote the benefits of online rent collection—as well as providing an ideal solution, but before looking into the benefits of online rent collection, let’s look at why cheques are such a bad option for collecting rent.

Why You Should Avoid Cheques for Rental Payments

These are a few examples of why accepting cheques for rental payments may lead to problems for landlords:

- People forget! Let’s face it—we’re all under so much stress. And with so many things to remember, the days of the month fly by, and tenants forget rent day.

- Various bills have to be paid on different days of the month. It is probably unintentional, but people get mixed up with what has been paid and what hasn’t.

- Cheques bounce. Tenants might tell you that they have posted the cheque, and this may be true. But if the money isn’t in the account, you won’t get paid.

- Cheque fraud is massive. Reports in 2018 said that attempted cheque fraud amounted to $15.1 billion. Successful cheque fraud cost a whopping $1.3 billion.

Why Online Rent Payments Should Replace Cheques.

1. Simplicity

Accepting rental payments by cheque means waiting for them to arrive in the mail and then a trip to the bank to pay into your account. It’s not so bad for one cheque, but multiple payments could mean multiple trips, a time-consuming process. Landlords and tenants appreciate the ease of use with online rental payment solutions.

2. On-time payments

The majority of online rental payment solutions allow tenants to set up automatic payments. The rental amount is taken out of the tenant’s account on the same day each month. If a tenant doesn’t want automatic payments, you can set up SMS or email reminders a few days before the rent is due. Tenant’s like this because they can avoid late payment fees.

3. Various payment options

Tenants have a variety of payment methods when paying rent online. These methods include eCheque, credit/debit cards, PayPal, via SMS or email or rent collection apps. The more methods available, the easier it is for tenants to pay on time.

4. Real-time financial

It’s challenging matching up rent payments into your account with the various tenants you may have. When collecting rent online, you will receive real-time notifications when you receive rent. This helps you keep track of who’s paid and who hasn’t. You can then quickly cheque your messages and confirm them against your list of payments

5. Increased security

Because cheques contain bank account details, lost cheques and fraud are possible. If a cheque is stolen, the tenant might not have money in their account to issue another cheque—further delaying the payment. When landlords and tenants opt for online rental payment solutions, there is a higher level of security. Depending on the software, users can benefit from encryption and compliance, knowing that all of their details are completely secure